working capital funding gap

Working capital is the difference between a companys current assets and current liabilities. The debt to equity ratio indicates.

Working Capital Cycle Definition How To Calculate

The proportion of the.

. 1b Allow customers to delay payments. Building effective working relationships between corporates and banks. To get idle funds 1.

Work to match up the days outstanding for trade payables with the days outstanding for accounts receivable. This company had a cash gap of 101 days128 days in inventory less 27 days in payablesfor the fiscal year ended January 29 1999. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt.

Tighten customer credit terms. The keys to managing the cash flow gap are as follows. Managing the working capital fund gap.

Working capital can be negative if current liabilities are greater than current assets. What actions could a company take to reduce its working capital funding gap. Working capital is the cash used daily cover all of a corporations.

Funding gaps can be covered by investment from venture capitalor angel investors equity sales or through debt offerings and bank loans. What actions could a company take to reduce its working capital funding gap. Send invoices early so that you can get inflows faster.

Raise the price of the products to increase. Stockpile the inventory and make sure they are not out-of-stock. A working capital loan can provide from 5000 to 500000 and we offer fast approval and funding.

Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. What actions could a company take to reduce its working capital funding gap.

Gaining a few days. Alternative Funding Group recognizes that a quick working capital loan for your. The action Company should take to reduce its working capital funding gap by Increasing inventory levels.

This is particularly prominent in supply chain funding. With annual sales of 32 billion it generated average. What actions could a company take to reduce its working capital funding gap.

Give customers a discount if they pay. Automation simplifies this a lot.

Gap Funding 100 Unsecured Loans

5 Levers To Keep Your Working Capital Cycle On Track Sme Magazine

Working Capital Finance Financing Siemens Global

Solved Calculate Accounts Receivable Days Based On The Chegg Com

Working Capital Funding Gap Problem Water Cooler Analystforum

The Best Way To Understand The Working Capital Fund Gap Mycfong

New Report Highlights Needed Solutions To Address Gaps In Access To Capital That Hold Back Entrepreneurs Of Color

Cash Conversion Cycle Formula And Calculator Step By Step

Funding The Cash Gap In Your Legal Practice Law Firm Finance

Working Capital Cycle Definition How To Calculate

Charter School Funding In Your State Charter Asset Management

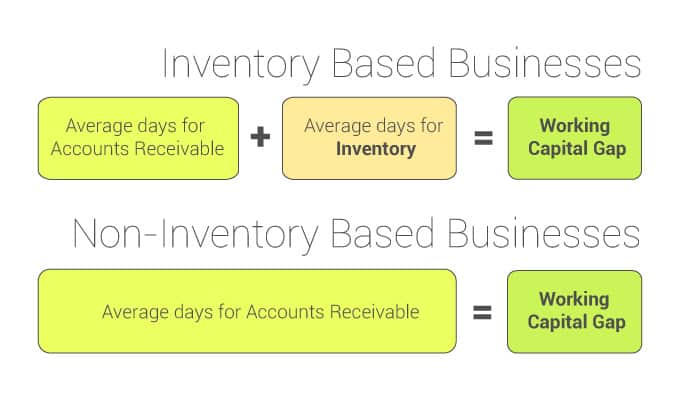

Credit Analyst How We Calculate Working Capital Funding Gap The Wcfg The Period Between Company Pays For Inventory Cash Out And Company S Customers Pays For Goods Cash In طريقة الحساب

Female Entrepreneurs Struggle To Get Adequate Funding Credit Suisse

Working Capital Cycle Efinancemanagement

Working Capital Financing 101 For Entrepreneurs

What Is Working Capital Its Formula Turnover Ratio Cycle Loan Gap Timesnext

Know Thy Numbers Installment 4 Cash Is King Cash Gap And Working Capital Financial Poise

How To Close The Working Capital Gap By Obtaining Working Capital Financing Via Alternative Lending Solutions Arviem Cargo Monitoring